The Problem

High-cost lenders are ignoring state law and continuing to lend high above the state's legal interest rates, using a practice called Rent-A-Bank.

In some cases, these rates are under 36% on very large loans. In others, rates are in the triple-digits, charging consumers up to 200% to finance car repairs, furniture, and even puppies.

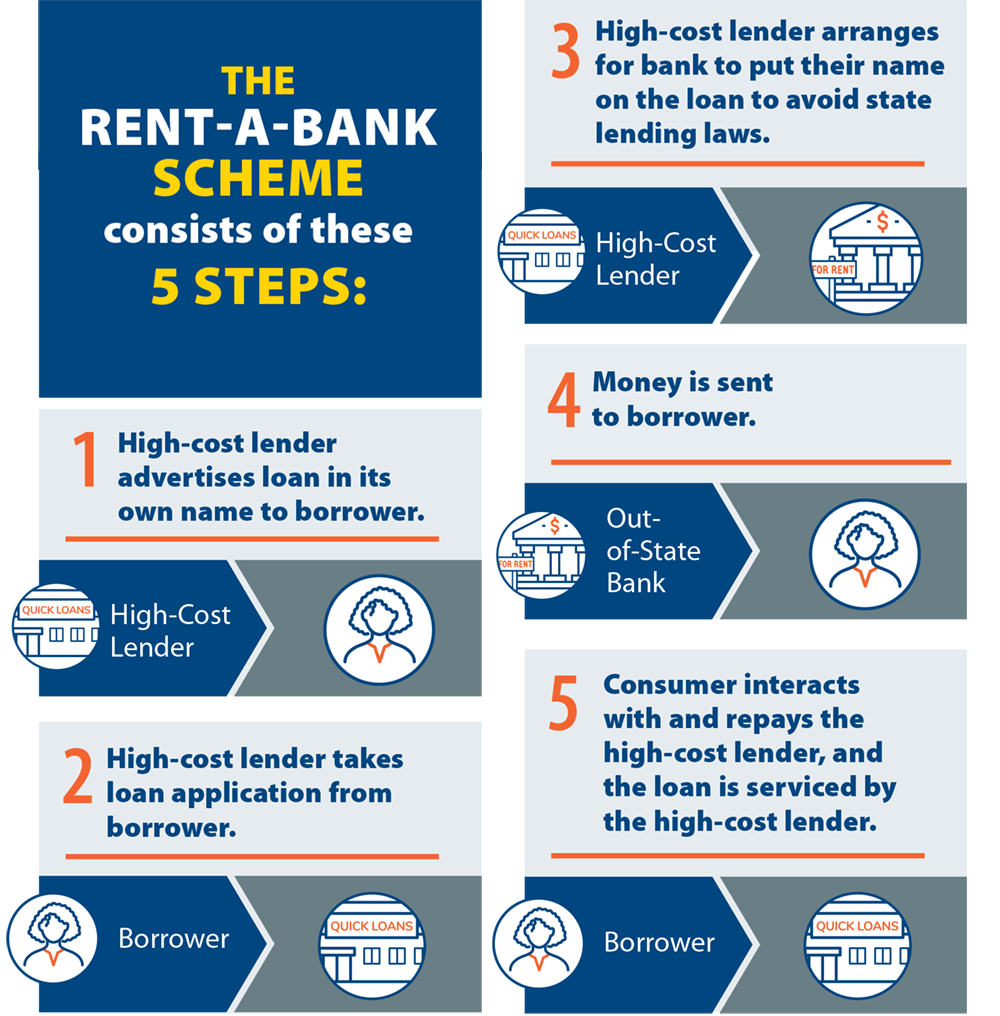

How Rent-A-Bank Works

In the 1990s payday lenders partnered with banks to create a practice known as Rent-a-Bank. This practice, which has now moved online, exploits a provision of federal law that allows banks to export their interest rates across the country, ignoring state laws meant to protect borrowers from abusive high-rate lending that can lead to a debt trap.

Rent-a-Bank arrangements allow online lenders to exceed state limits on loans used to finance the purchase of everything from puppies to car repairs, including expensive debt consolidation loans made to people already struggling to meet their monthly obligations. While some of the loans are typical triple-digit payday products, others are very large loans with a 36% annual percentage rate (APR) or higher. A 36% interest rate is appropriate for small, short-term loans. It is not appropriate for large loans paid over a period of years.

How To Stop It

In 2023, the state of Colorado addressed the reemergence of this scheme by passing legislation to opt out of the provision of federal law being exploited by predatory lenders and banks, giving the state more power to enforce its own lending laws for Colorado consumers.

Shortly thereafter, a lawsuit was filed by high-cost lenders and their allies to put this legislation on hold. While a judge temporarily stopped the law from going into effect, the State scored a major win when the Federal Deposit Insurance Corporation (FDIC) weighed in support of the State. This is important because the FDIC regulates the banks engaging in Rent-A-Bank lending and signals that they believe that states like Colorado can take steps to prohibit the practice.

The judge’s decision is currently being appealed. Center for Responsible Lending and others submitted amicus briefs supporting the right of states to enforce their own lending laws.

CRL Resources & Statements

- Amicus Brief: CRL and NCLC in Support of Defendants Appellants and for Reversal NAIB v. Weiser

- Amicus Brief: CRL and NCLC Urge Federal Appellate Court to Correct Reading of Federal Statute Permitting States to Reclaim Usury Authority

- Stop High-Cost Lenders from Evading State Laws: An Overview of Rent-a-Bank Schemes & the Simple DIDMCA Opt-Out Solution

- Burned Borrowers: A Look at the Experiences of OppFi Customers

- Adding Fuel to the Fire: OppFi Hurts, Does Not Help, Borrower's Credit Health

- Comments to FDIC from Coalirion on Community Reinvestment Act Examination of Rent-A-Bank FinWise Bank

- Consumer Rights Organizations Call on FDIC to Downgrade TAB Bank on its Conmmunity Reinvestment Act Exam

Additional Resources

- Amicus Brief: NAIB v. Weiser FDIC

- Amicus Brief: State Attorneys General

- Webinar: Time Running Out: Congress Should Repeal Rule Protecting Predatory Lenders Harming Small Businesses, Veterans, Consumers

- Correcting the Record: The OCC’s “Fake Lender” Rule Expands Harmful, Predatory Lending

- One Pager: The OCC and FDIC Plan to Trample State Laws by Gutting the Longstanding “True Lender” Doctrine

- Poll: Dangers of Rent-a-Bank Schemes "Two-thirds of voters (66%) are concerned about the ability of high-cost lenders to arrange loans through banks at rates higher than the state laws allow."

- Testimony: Rent-A-Bank Schemes and New Debt Traps

- Factsheet: Industrial Loan Company Charters Pose Risks to Consumers and the Economy: A Moratorium Is Needed

- Factsheet: Predatory Lenders’ Rent-a-Bank Scheme: What Is It and What Can We Do To Stop It?

- Factsheet: Prohibiting Rent-a-Bank Arrangements: A Longstanding Banking Principle

- Sign-on Letter: 120 Consumer, Civil Rights, Community Groups Oppose HR 4439 and Sham Rent-a-Bank Payday Lending

- Two pager: Rent-a-Bank Bill Could Open the Floodgates to Predatory Lenders: S1642 & HR3299

Statements

- Faith Leaders Call for Repeal of OCC Rule Blessing “Rent-a-Bank” Schemes

- Statement from the National Association of Federally-Insured Credit Unions

- Statement from the Conference Of State Bank Supervisors

- OCC Issues Final "True Lender" Rule that would Help Fraudulent, Predatory Loan Schemes (Oct 28)

- Advocates Condemn FDIC Rule that Encourages Predatory High-Cost Loans through Rent-A-Bank Schemes (Jun 25)

- Advocates Condemn Rent-a-Bank Rule that Encourages Predatory High-Cost Loans; Call on Congress to Pass Federal 36% Interest Rate Cap Limit (May 29 )

- Advocates Condemn Rent-a-Bank Rule that Encourages Predatory High-Cost Loans; Call on Congress to Pass Federal 36% Interest Rate Cap Limit (Feb 10)

- CRL Federal Campaign Director Testifies Before House Committee on Rent-A-Bank Schemes (Feb 7)

- CRL Federal Campaign Director Testifies Before House Committee on Rent-A-Bank Schemes (Feb 7)

- https://www.responsiblelending.org/media/advisory-house-committee-hearing-predatory-lending-rent-bank-schemes-feature-crl-nclc (Feb 6)

- Consumer and Civil Rights Groups Urge Federal Banking Regulator to Stop Rent-a-Bank Payday Loan Schemes (Jan 22)