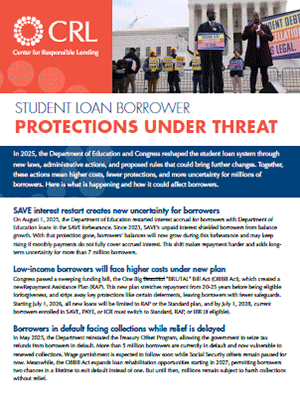

In 2025, the Department of Education and Congress reshaped the student loan system through new laws, administrative actions, and proposed rules that could bring further changes. Together, these actions mean higher costs, fewer protections, and more uncertainty for millions of borrowers. Here is what is happening and how it could affect borrowers.

CRL Advocacy Priorities

- Protect affordability: Defend SAVE and other affordable IDR plans and push back against forced transitions that drive up costs and harm borrowers.

- Stop punitive collections: Expand rehabilitation and income-based recovery before resuming garnishments. Preserve PSLF integrity: Oppose ideological exclusions and ensure PSLF remains a program that helps communities attract teachers, healthcare workers, and other essential workers.

- Expand borrower protections: Push for earlier access to Borrower Defense & Closed School Discharge improvements.

- Rebuild ED capacity: Call for adequate staffing and funding for FSA to improve servicing and ensure timely and fair treatment for borrowers.