The Center for Responsible Lending (CRL) in 2021 continued its focus on creating lasting structural change in the systems, products, and policies that prevent Americans—families of color, rural, women, military, low-wage, low-wealth, and early-career workers and communities—from establishing and sustaining economic stability and security. At the same time, the effects of a global pandemic brought the inequities of the United States financial system into sharper focus, making the struggles of working households to reach and maintain middle class stability seem more uncertain than ever.

Dear Friends:

At CRL, we are proud of our 20-year track record of trusted, solutions-oriented research and policy prescriptions to help those historically overlooked and underserved overcome the financial exploitation, misguided policies, and regulatory inaction that too often act as roadblocks preventing Americans from achieving economic security.

CRL’s groundbreaking research illuminates how predatory financial products, external economic stressors, and inadequate regulatory oversight intersect and magnify the negative effects of longstanding systemic inequities. Our policy recommendations and advocacy, amplified by work with local and national partners, help protect all Americans – particularly communities that are underserved or harmed by the nation’s deep-seated and perpetual legacy of racial inequality – from financial exploitation and predatory wealth-extracting products.

In 2021, CRL’s recommended policy solutions mobilized consumer advocates, engaged state and federal elected officials, and influenced regulatory action by presenting a compelling case for reform to eliminate racial wealth disparities and help more Americans achieve financial security.

With a change in Administration, we were able to seize on a rare opportunity to regain momentum around efforts to ensure social and economic justice for all Americans through adoption of common-sense solutions and rollbacks of previous anti-consumer regulatory decisions. Despite the raging COVID-19 pandemic and extreme partisanship, CRL continued to make a difference and achieve monumental successes that benefited consumers. Among them:

In addition, our advocacy, research, and Congressional testimony helped lead the Consumer Financial Protection Bureau (CFPB) to launch a closer review of emerging threats such as Buy Now Pay Later and other fast-growing fintech products aimed at low-wage, low-wealth, military, and other hard-working Americans already struggling to make ends meet.

COVID-19 brought unpredictability to the world and our nation. CRL has worked vigorously to identify effective solutions that benefit low-and-moderate income families, small business owners, and communities of color. We are focused on easing consumer debt burdens, which were ballooning even prior to the pandemic. Both federal leadership shifts and adoption of common-sense solutions are making a difference, and dangerous decisions now are being rolled back, to the benefit of consumers.

As the nation continues its journey of racial reckoning, we spoke out against too many perpetrators still escaping accountability for the unjustified killings of Asian, Black, and Latino citizens across the nation—notwithstanding the conviction of a police officer in the killing of George Floyd in Minneapolis.

With your support, we will continue our advocacy to expand financial opportunity and security and move the nation toward racial and economic equity.

With appreciation,

Mike Calhoun

COVID-19 Economic Relief and the Black CommunityMay 18 Facebook Live Town Hall

Watch Nikitra Bailey, CRL Executive Vice President, discuss how COVID response must address structural harms to communities of color at 44:32.

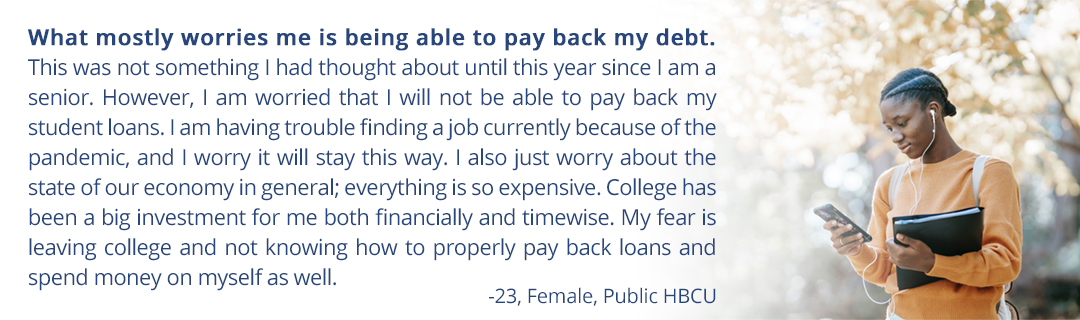

CRL continued its focus on the student loan debt crisis. The roughly $1.7 trillion federal student debt burden kept many early-career workers from starting a family, launching a business, or purchasing a home — the primary means of building wealth in the United States. We highlighted how student loan debt reflects the nation’s legacy of discrimination and contributes significantly to the racial wealth gap, with Black and Latino borrowers shouldering a disproportionate share of the debt burden.

Our research also found that older Americans are not exempt from the hardships created by unaffordable student loans. The number of student borrowers over age 60 has quadrupled in recent years, and as of 2017, 40% of student borrowers over age 65 were in default. In 2021, CRL joined with allies to advocate for $50,000 in widespread student loan cancellation. We also published research reports and data, co-created a documentary film—"My Yard, My Debt: The HBCU Student Borrower Experience”—and held live and virtual events to draw attention to this crucial issue. We also conducted a poll in Minnesota that showed bipartisan public support for debt cancellation, just like previous polls conducted in different

states.

While we continue our quest for cancellation, the new student loan provisions found in the American Rescue Plan are major wins. The law closed the 90/10 loophole, preventing predatory for-profit colleges from targeting veterans and wasting taxpayer funds. Also, students no longer will be taxed for receiving debt relief from their lender.

In addition, more than a dozen states have passed laws to defend borrowers against predatory loan servicers. The new Department of Education acknowledges the importance of state action, having corrected the previous Administration’s anti-borrower positions. CRL also provided technical assistance for a student loans episode of Vox’s “Money, Explained” program on Netflix.

Efforts to circumvent state usury laws were crushed when President Biden signed bipartisan Congressional legislation on June 30 rescinding the Office of the Comptroller of the Currency (OCC) “fake lender” rule that enabled predatory rent-a-bank schemes. CRL and allies secured victory over the banking lobby through a persistent campaign of webinars, comments and sign-on letters, and Senate Banking Committee testimony.

CRL also provided analysis and outreach materials to inform and empower consumers, local advocates, and national partners seeking to eliminate predatory payday lending. As a result, in 2021, bipartisan members of Congress– including Senators Jack Reed, Sherrod Brown, Jeff Merkley and Chris Van Hollen, and Representatives Chuy Garcia, Glenn Grothman, and more than a dozen other House co-sponsors – introduced the Veterans and Consumers Fair Credit Act. The measure builds on the 2006 bipartisan Military Lending Act capping payday loans at 36% APR and opens protections to all Americans (while not preempting state usury limits). At the state level, on March 23, Illinois became the 18th state, along with the District of Columbia, to make triple-digit interest payday loans illegal within its borders. That means 12 million more people now live in states that offer strong protections against the Payday Loan Debt Trap.

CRL called for regulation of Buy Now Pay Later (BNPL) and other fintech products in November testimony before the House Financial Services Committee’s Task Force on Financial Technology. Concern about the affordability of BNPL also applies to Earned Wage Access (EWA) loans against wages earned but not yet paid.. Just more than a month later, CFPB announced an inquiry into BNPL firms and their business practices to ensure that these products do not harm consumers.

CRL sounded the alarm over wage garnishment as a debt collection method that puts low- and moderate-income households—and especially Black and Latino families—at risk. On December 15th, CRL hosted the Economic Policy Institute, Groundwork Collaborative, Insight Center, and National Consumer Law Center for a panel discussion on the emerging national movement to protect $1,000/week of wages from garnishment.

Fintech lender Oportun had sought a national bank charter but withdrew it under pressure from CRL and consumer advocates in early October. This significant victory is the result of CRL and California allies’ work exposing Oportun’s history of targeting Latinos and immigrants with unaffordable loans and predatory debt collection practices. The company has been under investigation by the CFPB for a year. CRL found that Oportun was among the top filers of debt collection cases in Los Angeles County from 2018 through 2020, affirming other research that showed Oportun’s position among the top filers of debt collection lawsuits in both California and Texas.

Despite abandoning its own bank application, the lender continues to attempt to use out-of-state banks under a rent-a-bank model to expand its ability to reach consumers with high-cost loans that are notpermitted by non-banks under the laws of certain states. CRL will continue to monitor these attempts to circumvent state usury limits.

More than 15 years of CRL research and advocacy have highlighted major banks’ reliance on unnecessary and abusive (though profitable) overdraft fees. The financial strains of the pandemic exacerbated the impact of these fees, and regulators and the banking industry took notice. These outrageous fees disproportionately impact low-income, Black, and Latino Americans with small account balances.

The Consumer Financial Protection Bureau (CFPB) compiled extensive documentation of the problem and bank CEOs at PNC and Ally publicly characterized the overdraft model as broken and bad for customers. Ally decided to eliminate overdraft practices in early June. CRL’s Rebecca Borne participated in the Brookings-sponsored, “The Future of Bank Overdraft Fees” panel. U.S. Representative Carolyn Maloney and Senators Cory Booker and Elizabeth Warren reintroduced legislation in the House and the Senate to provide strong consumer protections and enable vulnerable populations to more safely use the banking system. CRL’s efforts saved consumers more than $5 billion annually in unnecessary and excessive fees.

Stable homeownership and home equity wealth can dramatically improve families’ financial security and potential for advancement. Yet the racial homeownership gap today is wider than it was in 1968, when housing and lending discrimination were first barred by the Fair Housing Act. Helping Black and Latino consumers become homeowners, and at earlier ages, is essential to promoting social equity and the nation’s economic resiliency. One solution that was launched in 2021 to address these gaps is the Racial Wealth Gap Initiative (RWGI), a long-term joint effort between CRL and Self-Help to research, test and scale a range of new affordable mortgage products to help low-wealth families overcome historical barriers to homeownership, including lack of money for a large down payment, low savings/reserves, and more. The RWGI expands the work CRL has been involved in for 20 years, and that our affiliate, Self-Help, has been leading for 40 years.

Yet the racial homeownership gap today is wider than it was in 1968,

when housing and lending discrimination were first barred by the Fair Housing Act.

2021 was a demanding time for CRL staff on Capitol Hill, even though they were unable to step foot in the Capitol complex. CRL was instrumental in driving the inclusion of a targeted Homeowner Assistance Fund at the Department of Treasury in the American Rescue Plan that initially allocated $10 billion toward states and territories to help homeowners struggling during COVID to make mortgage payments. HUD Secretary Marcia Fudge returned fair housing rules to their original intent, including restoring the use of the disparate impact rule to identify and eliminate discriminatory housing practices. CRL partnered with Self-Help Credit Union and Self-Help Federal Credit Union on a supportive comment letter.

We also worked to ensure $7 billion of the Paycheck Protection Program (PPP) is targeted at eligible non-profits, testifying at a virtual hearing before House Financial Services on extending targeted aid during the recession and public health crisis. The Paycheck Protection Program (PPP) was supposed to help small businesses survive the COVID crisis. However, CRL research documented early on that the program was not reaching businesses of color due to its structural flaws. In collaboration with our parent organization, Self-Help Credit Union, we sought a retroactive adjustment to the PPP so that businesses that previously missed out on the level of relief they needed now have the chance to move forward. CRL also led efforts to ensure that those businesses that received PPP loans received fair loan forgiveness opportunities. CRL also led a deeper dive on the PPP—particularly for small business owners of color—on Full Frontal with Samantha Bee.

In August, CRL released Hardship for Renters: Too Many Years to Save for Mortgage Down Payment and Closing Costs, that revealed, based on income, a typical white renter household needs 9 years, a Latino renter household 11 years, and a Black renter household 14 years to save for a minimal down payment of 5% for a mortgage.

In California, we advocated for criminal justice bail reform and wage protection for consumers during garnishment proceedings. We challenged abuse by debt settlement companies that hijacked the court system to take advantage of debtors using threats of litigation and engaging in efforts to collect debts from people who may not have owed them.

CRL also joined with other advocates to urge the three major credit bureaus to correct credit report problems for transgender and nonbinary consumers. In addition, CRL led comments supporting a CFPB rule to expand data collection and reporting requirements to give regulators the information needed to ensure lending is being extended fairly to women- and minority-owned small businesses.

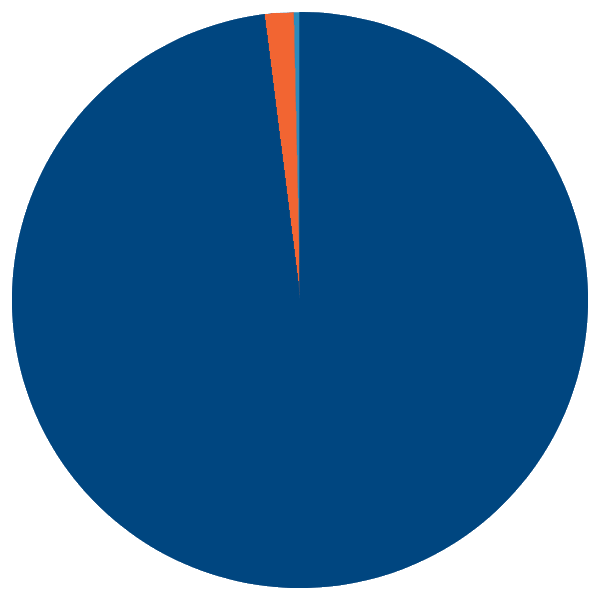

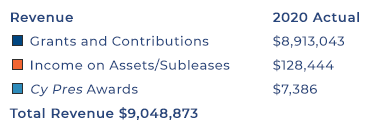

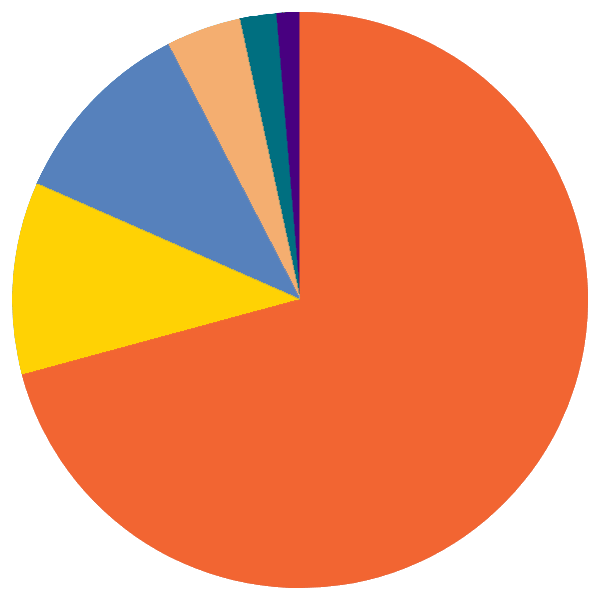

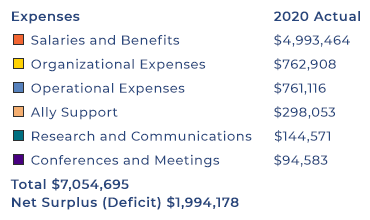

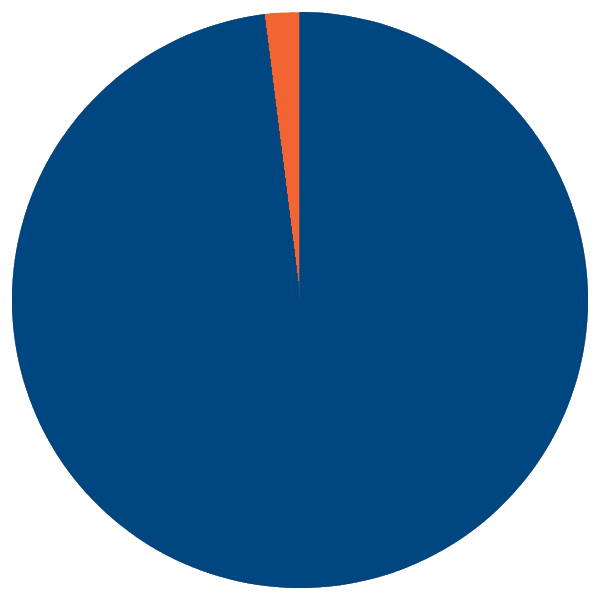

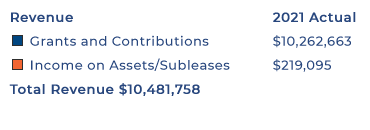

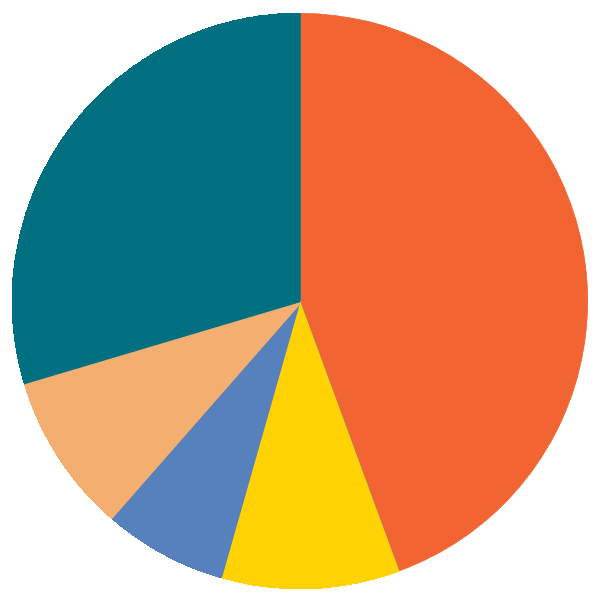

NOTE: Grants and Contributions include multi-year commitments provided in 2021 and do not reflect funds available to be spent in 2021.

CRL extends our deepest gratitude for your generous support of our mission.

*Donor advised funds are included among institutional donors

We recognize and celebrate our partnership with the San Francisco, CA-based Friedman Family Foundation. CRL established its California office in 2006 to address the subprime mortgage crisis and rein in payday lenders. Grants Administrator, Lisa Kawahara, and Friedman Family board members had faith in us from the start, well-knowing action in their bellwether state could produce local and national reform.

Since 2009, CRL received general support grants that helped usher in conditions favorable to consumers. Specifically, the Foundation participated in the reform movement to curb abusive home lending nationally and realize a 36% interest rate cap law (AB539) on high-cost installment loans in California. As the Foundation prepares to close its doors after more than 32 years, we honor the Friedman Family and extend our deep appreciation to Lisa Kawahara. Lisa has been a perpetual source of encouragement and kindness and we wish her the best.

Learn more about CRL’s work online at www.responsiblelending.org and across our social media.

CRL’s efforts are made possible by the generous support of foundations, companies, cy pres awards, and individuals committed to financial fairness.

North Carolina

302 West Main Street

Durham, NC 27701

919.313.8500

California

1970 Broadway Suite 350

Oakland, CA 94612

510.379.5500

District of Columbia

910 17th Street NW Suite 800

Washington, DC 20006

202.349.1850