A new bipartisan poll of likely 2016 voters finds that voters across party lines strongly oppose unfair lending practices and support financial regulations and enforcement by the Consumer Financial Protection Bureau.

Strong Bipartisan Support

Download the full memo (PDF)

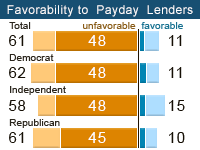

In particular, voters of all parties oppose a range of common payday lending practices, and strong majorities across party lines want the CFP to enforce tougher regulations to protect consumers from financial abuse.

- Nearly half of all voters surveyed (48%) across party lines report "very" unfavorable views for payday lenders.

- Over three-quarters of voters (76%) would support a much lower cap on payday loan interest rates; 70% of Democrats, 68% of Independents, and 65% of Republicans surveyed report "strong" support of a rate cap. (Currently rate caps can grow to over 400% APR)

- Nearly 80% of voters surveyed support a proposal that payday lenders be required to check a borrower's ability to repay a loan. Support for this proposal is even stronger among Independents (81%) and Republicans (80%) than among Democrats (73%).

Christian Voters Hold Particularly Unfavorable Views of Payday Lenders

Download the Christian support memo (PDF)

- Four in five Christian voters (79%) would support an interest rate cap on payday loans; four-fifths (78%) of Christians would support a proposal that payday lenders be required to check a borrower's ability to repay a loan.

- Three-quarter (75%) of Protestants and 80% of Catholics oppose a situation in which a payday lender's payment could come before food, utilities, or other family budget priorities.

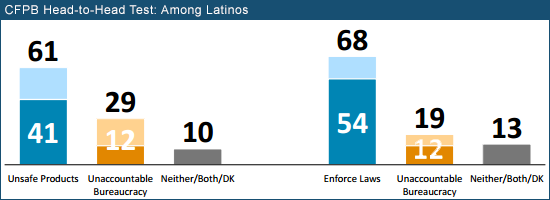

A Majority of Latino Voters (55%) have Unfavorable Views of Payday Lenders

Download the Latino support memo (PDF)

- Similar to voters of other ethnicities, nearly four-fifths of Latinos would support an interest rate cap on payday loans, including nearly two-thirds (64%) who would "strongly" support such a rate cap.

- Seven in ten Latino voters would support a proposal that payday lenders be required to check a borrower's ability to repay a loan; 68% would support a rule that payday lenders be required to check a borrower's ability to repay a loan within that loan's stated time period.